Understanding Debt, Borrowing, and Credit

Explaining Debt, Borrowing, and Credit to Your Child

Understanding debt, borrowing, and credit is crucial for children as they grow into responsible adults.

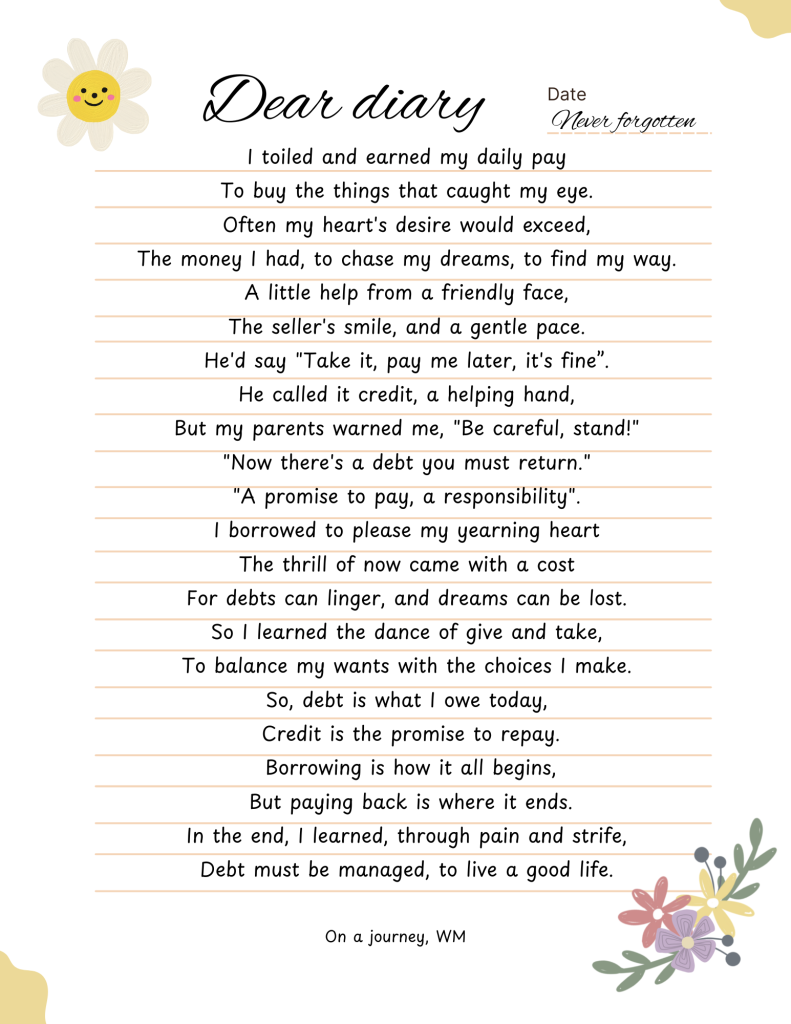

As a parent, one of the most valuable lessons you can teach your child is how to manage their finances responsibly. Understanding debt, borrowing, and credit is crucial for making informed decisions about money, and it’s never too early to start the conversation.

However, these concepts can be complex, but with the right approach, parents can explain them in a way that is both engaging and informative.

But first…

Before you teach your children about debt, borrowing and credit, let us address your approach to the subject.

Borrowing: The Good, the Bad, and the Ugly

Borrowing can be a useful tool, but it’s essential to teach our kids the difference between good debt and bad debt. Good debt, like a mortgage or student loan, can help them achieve long-term goals. Bad debt, like credit card balances, can lead to financial trouble. Teach them to borrow only what they need, and to always consider the interest rates and repayment terms.Credit: A Double-Edged Sword

Credit can be a valuable tool, but it can also be a curse. Teach your kids that credit is like a report card for grown-ups and their money habits. A good credit score can open doors to better loan rates and financial opportunities, but a bad credit score can make it harder to get credit in the future.

Definitions

What is Debt?

Debt is money that someone owes to someone else. Use relatable examples, like borrowing a toy and needing to return it later.

Here’s an example that you can vary depending on age and level of comprehension

Imagine you really want a new bike, but you don’t have enough money in your savings. Your parents might offer to lend you the money, but you promise to pay them back later. This is like borrowing money from a bank, but instead of getting cash, you get the bike. The money you owe to your parents is called debt.

What is Borrowing?

Borrowing is when you take something from someone else, like money or an object, with the promise to return it later. When you borrow money, you’re committing to pay it back, usually with some extra added on top, called interest.

To explain the concept of borrowing and how it differs from debt, you can use numerous examples such as the one below.

If you want a new video game but don’t have enough money, you may borrow money you had put aside for something else with the commitment to return the money.

What is Credit?

Credit is the ability to borrow money or access goods or services with the understanding that you’ll pay for them later. It’s essentially a financial trust given by a lender to a borrower.

While the terms above can be confusing, here is a simple analogy to use to explain credit.

Imagine you want to buy the latest PlayStation but your and your parents don’t have the money to do so. Your parent can go to the bank and borrow some cash. Alternatively, the gaming shop can allow your parent to take the PS and your parent can come and pay for it later.

Why Debt Education Matters

Debt can be a significant burden for anyone, and it’s crucial to teach our kids how to manage it wisely. By educating them about debt, we can help them make informed money decisions and avoid financial pitfalls.

Teaching Debt, Borrowing, and Credit

- Start early: Begin teaching your kids about debt, borrowing, and credit when they’re young, so they can develop good habits from the start.

- Use real-life examples: Use everyday situations, like buying a car or taking out a student loan, to explain the concept of debt and borrowing.

- Practice what you preach: Show your kids that you practice responsible borrowing and credit habits yourself.

- Encourage saving: Teach your kids the importance of saving and budgeting, so they can make smart financial decisions.

- Monitor their spending: Keep an eye on your kids’ spending habits and have open conversations about their financial choices.

Conclusion

Getting our children to understand debt, borrowing, and credit is an essential part of raising financially savvy and independent children. By starting the conversation early and providing them with a solid understanding of these financial basics, we can set them up for a lifetime of financial responsibility and independence.

By taking the Moski Money Challenge and Money Personality Test, your child will gain confidence and knowledge and with your guidance, a lifetime of financial responsibility and independence.

Unlock the secrets to financial literacy and give your child the tools they need to thrive in an increasingly complex financial world. Sign up now and take the first step towards raising a financially savvy and independent child!