Developing Financial Responsibility and Generosity in Your Child

Teaching your child to be financially responsible, is a daily exercise with the aim of having children grow up to be financially responsible and independent. We also want to instil in them a sense of social consciousness and generosity. In a world that constantly promotes consumerism, it is vital to strike a balance that fosters both fiscal prudence and a spirit of giving.

We make a living by what we get, but we make a life by what we give – Winston Churchill

The Importance of Financial Responsibility

Teaching your child to be financially responsible is essential for their future well-being. It helps them understand the value of money, how to manage money, save, budget, make smart financial decisions, and avoid debt. By encouraging your child through the foundational and healthy financial disciplines you will be setting them up for long-term financial stability.

Here are some key strategies:

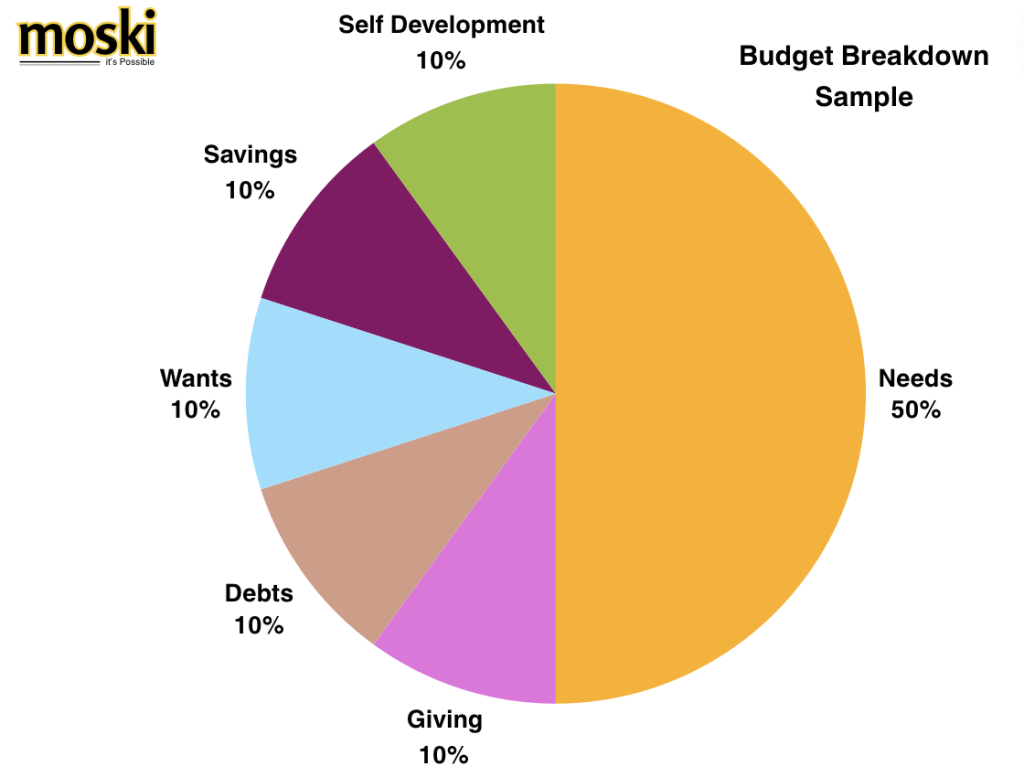

- Introduce Basic Concepts Early: Start with simple lessons about money. Use allowances to teach budgeting and saving. Encourage your child to set aside a portion for savings, spending, and giving.

- Model Good Financial Behavior: Children learn by observing. Demonstrate responsible financial habits in your own life, such as budgeting, saving for emergencies, and making thoughtful purchases.

- Encourage Goal Setting: Help your child set financial goals, whether it’s saving for a toy or a larger item. This teaches them the value of patience and planning.

Fostering Generosity

While financial responsibility is vital, teaching children to be generous is equally important. Generosity can help children develop empathy and a sense of belonging as they understand that they are part of a larger community and that their actions can make a positive impact.

This can be achieved by encouraging them to donate to charity, volunteer their time, or simply be kind to those in need.

Here are some ways to encourage a spirit of giving:

- Lead by Example: Share your own experiences of giving, whether it’s donating to charity, volunteering, or helping a neighbor. Discuss the impact of these actions on others.

- Incorporate Giving into Their Budget: Encourage your child to allocate a portion of their allowance or earnings for charitable donations. This reinforces the idea that sharing is a part of financial management.

- Engage in Community Service: Involve your child in community service projects. This hands-on experience allows them to see the direct impact of their generosity and fosters a sense of responsibility towards others.

Financial Responsibility & Generosity – Striking a Balance

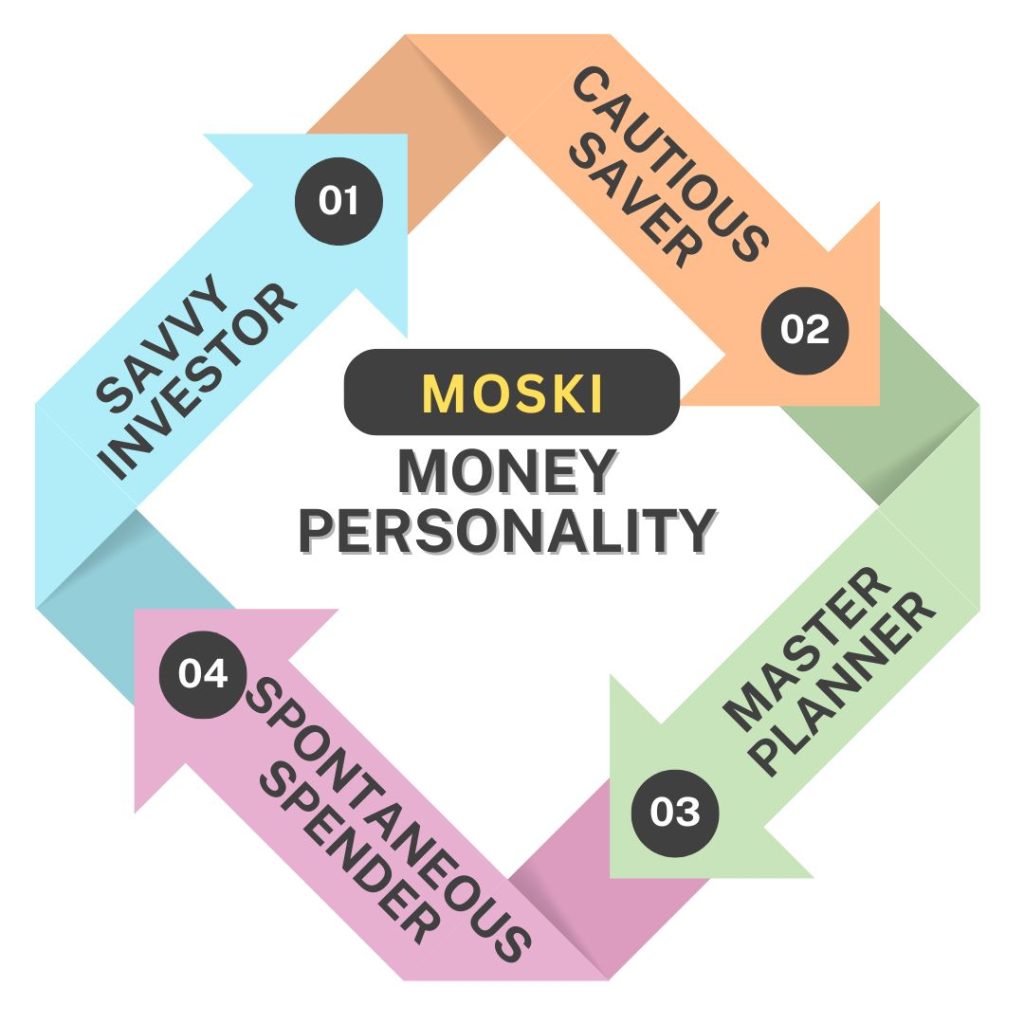

Balancing financial responsibility with generosity is about creating a mindset. It starts with knowing your child’s money personality.

Once you have this base, the following guides can help you teach your child to be financially responsible and generous.

- Set aside a portion of their allowance for giving back: Encourage your child to donate a portion of their allowance or income to a charity or cause they care about.

- Involve them in financial decisions: Encourage your child to participate in financial decisions, such as budgeting for a family vacation or donating to associations driving a worthy cause e.g. feeding people living on the street, children’s home etc.

- Lead by example: Show your child the importance of giving back by volunteering your time and resources to causes you care about.

- Make it fun: Make giving back a fun and engaging experience for your child. For example, you could participate in a charity walk or organize a bake sale together.

- Discuss Values: Talk about the values that matter to your family, such as kindness, empathy, and community support. Help your child connect these values to their financial decisions.

- Celebrate Generosity: Recognize and celebrate acts of generosity within your family. This can reinforce the importance of giving and encourage your child to continue these behaviors.

- Encourage Reflection: After charitable acts or financial decisions, encourage your child to reflect on how they felt. This can help them understand the emotional rewards of both saving and giving.

Next Steps

As you evaluate tools to teach your child to be financially responsible, the 1 x Moski Money Challenge is an excellent resource for teaching your child about financial responsibility and generosity. The interactive activities help the children develop essential money skills, while their personalized feedback and guidance encourage kids to make smart financial decisions.