Healthy Balance of Money Personalities

Over the past five weeks, we’ve been on an eye-opening journey, equipping you with the essential principles and strategies to instil rock-solid financial discipline and healthy money habits in your children. We’ve explored the transformative power of small, consistent actions, the magic of compound growth, the importance of steadfast discipline, and the joy of celebrating milestones. Now, as we reach the pinnacle of this transformative series, we’re about to unlock the final – and arguably most crucial – piece of the puzzle.

This week, we dive deep into understanding and nurturing your child’s unique “money personality.”

Guiding Your Child to Achieve a Healthy Balance of Money Personalities

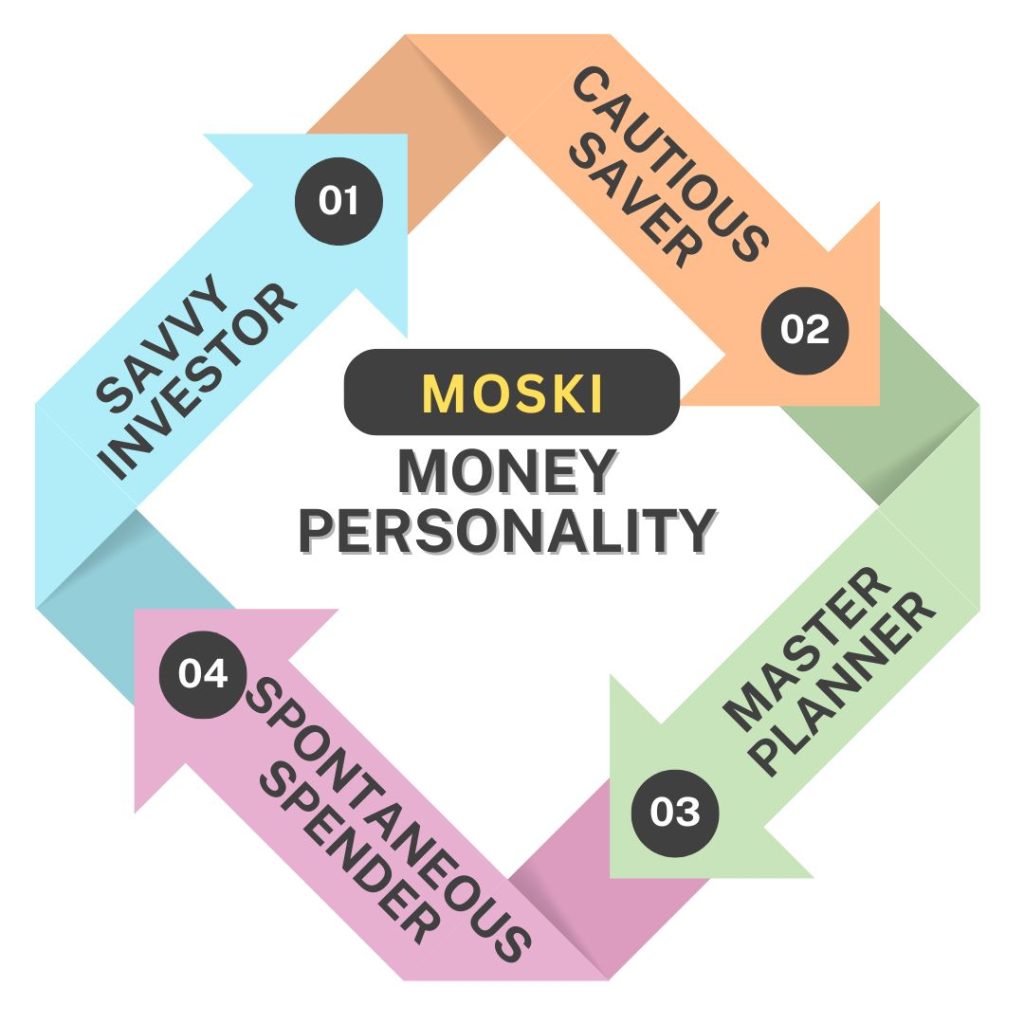

Whether they’re a meticulous Saver, a strategic Investor, a passionate Spender, or a methodical Planner, tailoring your approach to their individual needs is the key to unlocking their path to lifelong financial prosperity.

Have you taken the Moski Money Personality Test?

Every child has a unique money personality, which can be categorized into four main types:

- Savers: Savers are cautious and like to keep their money safe. They often prioritize saving over spending.

- Investors: They are risk-takers who look for opportunities to grow their money. They are often interested in stocks, real estate, and other investment strategies

- Spenders: They enjoy using their money to buy things they want and need. They often choose immediate gratification over long-term savings.

- Planners: They are meticulous and like to have a clear plan for their money. They create budgets and track their expenses carefully.

Understanding and balancing these personalities can help your child develop a healthy relationship with money.

If Your Child is a Saver

- Encourage Diversification because while saving is important, it’s also vital to teach your child about the benefits of investing and spending wisely. Encourage them to allocate a portion of their savings towards investments or spending on meaningful experiences.

- Teach Risk Management: Help your child understand that some level of risk is necessary for growth. Introduce them to low-risk investments like savings bonds or a beginner’s stock portfolio.

- Celebrate Small Spending: Encourage your child to spend a small portion of their savings on things they enjoy, like a favorite book or a fun activity. This helps them understand the value of enjoying their hard-earned money.

The Child with an Investor Personality

- Teach Risk vs. Reward: Investors often take risks, but it’s essential to teach your child about the importance of balancing risk with caution. Discuss the potential downsides of investments and the need for diversification.

- Encourage Saving: While investing is important, it’s also crucial to save for emergencies and long-term goals. Encourage your child to set aside a portion of their money for savings.

- Foster a Planner Mindset: Help your child understand the importance of planning and budgeting. Encourage them to create a budget that allocates funds for investments, savings, and spending.

If Your Child is a Spender

- Teach Budgeting: Spenders often struggle with saving and investing. Teach your child how to create a budget that allocates funds for savings, investments, and spending.

- Encourage Saving and Investing: Help your child understand the importance of saving for the future and investing for growth. Encourage them to set aside a portion of their money for these purposes.

- Promote Mindful Spending: Teach your child to be mindful of their spending habits. Encourage them to think about whether each purchase aligns with their values and goals.

The Planner Child

- Encourage Flexibility: Teach your child the importance of being adaptable and open to new opportunities. Planners often get caught up in their plans and may struggle with flexibility.

- Teach the Value of Spending: Encourage your child to allocate some funds for spending on things they enjoy because it is also important to enjoy the fruits of their labour.

- Foster a Growth Mindset: Help your child understand that plans can change, and it’s okay to adjust their budget and financial goals as needed.

Achieving a Healthy Balance

- Model Balanced Behavior: Children often learn by example, so make sure you’re living out a balanced approach to money management.

- Encourage Diverse Activities: Engage your child in various activities that expose them to the various money personalities. For example, encourage them to save for a long-term goal, invest in a beginner’s stock portfolio, and spend on meaningful experiences.

- Open Communication: Encourage open communication with your child about money. Discuss their financial goals, challenges, and successes regularly.

Action Steps for Parents

- Identify Your Child’s Money Personality: Take some time to understand which money personality your child leans towards with the Moski Money Personality Test. This will help you tailor your approach to their unique needs.

- Create a Balanced Plan: Develop a plan that encourages your child to adopt aspects of all four money personalities. This could include setting aside money for savings, investments, spending, and planning.

- Teach Financial Literacy: Educate your child about the basics of personal finance, including saving, investing, spending, and planning. Use real-life examples and interactive tools, games, and programs to make learning fun and engaging.

Resources for Parents

- Books: “The Investor” by Edwin Kiarie, “The Total Money Makeover” by Dave Ramsey, “Smart Money, Smart Kids” by Dave Ramsey and Rachel Cruze

- Online Tools: Websites like Moski Money Personality Test, 1xMoski Money Challenge, and other apps can help your child learn about money management in a fun and interactive way.

- Family Activities that teach financial literacy are encouraged and they can include creating a family budget, playing money management games, or starting a small family business.

By seamlessly blending the foundational financial habits we have cultivated with a deep appreciation of your child’s money mindset, you’ll empower them to develop a well-rounded, healthy, and empowered relationship with their finances. This powerful combination will set them up for long-term success, ensuring their financial well-being for decades to come.