The Money Mindset

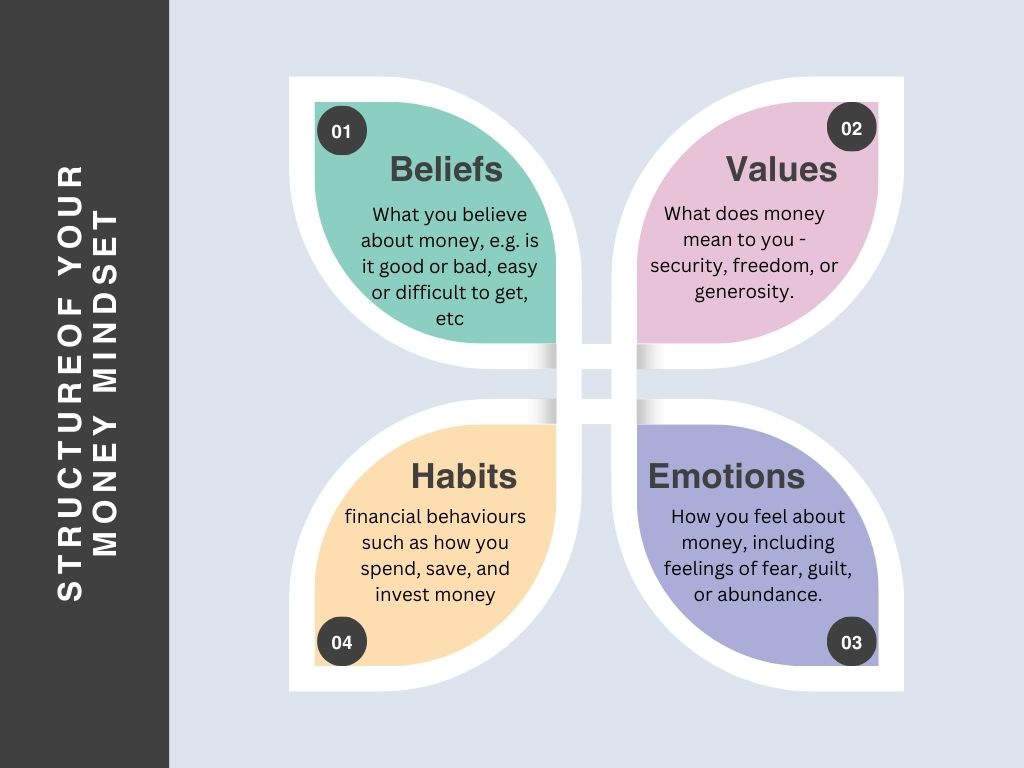

Money mindset refers to the collection of beliefs, attitudes, and emotions that shape our relationship with money.

It is about how we think, feel, and behave with money – earning, spending, saving, giving, investing and other money activities. Our money mindset influences our financial decisions, habits, and financial well-being.

A person’s money mindset can be either:

Positive: Healthy, constructive, and empowering, leading to financial confidence, security, and success.

Negative: Unhealthy, limiting, and destructive, leading to financial stress, anxiety, and difficulties.

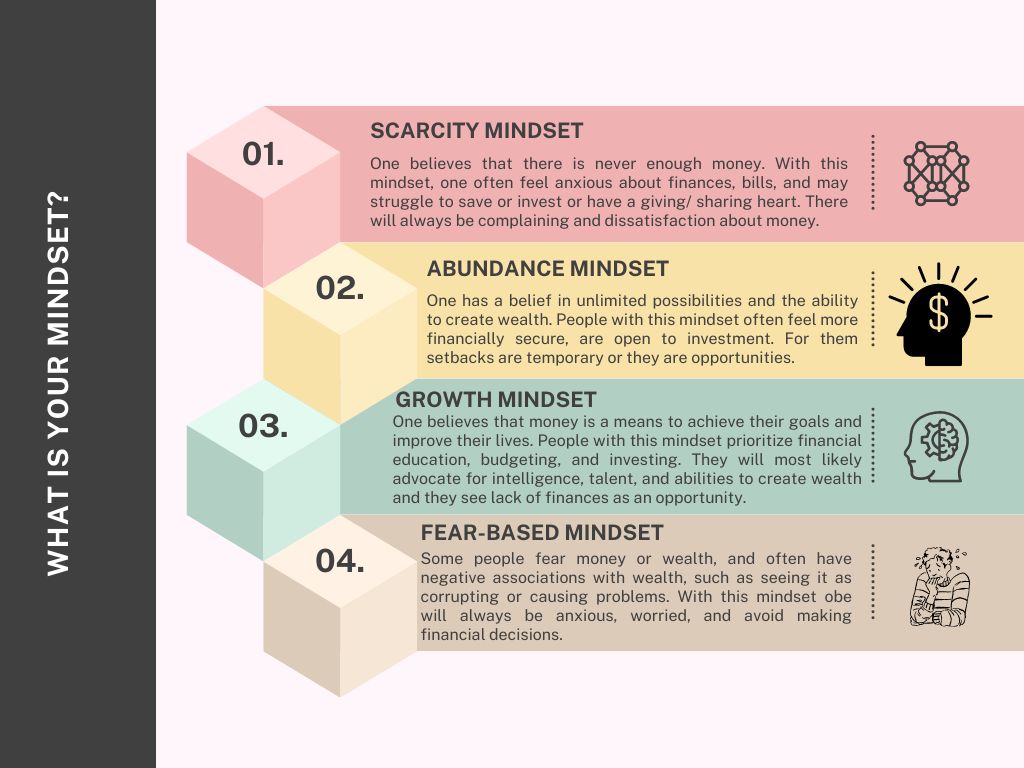

Types of Money Mindsets

Having a positive money mindset requires you to be someone who:

- believes money is a resource/ tool

- loves and respects people and uses money for the greater good

- has a heart of gratitude

- can set financial goals, create a budget, and make conscious decisions about how to spend and save money.

- believes in the abundance of resources

Questions to guide you to understand your money mindset.

- Do I feel financially secure?

- What are my core beliefs about wealth and financial success?

- How do I handle unexpected financial setbacks or gains?

- What is my earliest memory of money?

- How do I feel about earning my money?

- Do I believe money is scarce or abundant?

- Do I have the knowledge, abilities, and skills to increase my opportunities for attaining financial wealth?

- What fears or anxieties/ worries do I have when it comes to money?

- Is my self-worth and happiness congruent or attached or directly proportionate to the amount of money I have and my financial success?

- What are my income-generating, spending, budgeting, and investing habits?

- How do I perceive debt?

- If I lost all my financial gains and leverage today, what would be my fall-back plan?

- Do I have financial goals and how do I plan to achieve them?

- How does my relationship with money impact my relationships with others?

- Is my financial success set up to impact others including my children’s children?

You can also watch several episodes of Ramit Sethi’s I Will Make You Rich series on YouTube to see the impact of mindset on how people deal with their finances and how they impact relationships.

Whatever your mind set, we encourage you to do two things for your children:

- Take the Moski Money Personality Test

- Take the 1x Moski Money Challenge Course

By the time you’ve completed these two foundational paths, you’ll not only have equipped your child with a strong financial foundation, but you’ll also have embarked on a transformative journey of financial self-discovery, emerging with a deeper understanding of your money mindset and habits.

Cultivating a Growth Money Mindset

A positive money mindset can be a powerful tool for improving your financial situation. As parents, despite our busy schedules and demands, we must make a conscious effort to have this positive mindset and help our children cultivate it for themselves because it impacts financial decisions and ultimately, the family’s financial well-being.

It starts with becoming aware of your current beliefs and habits, challenging negative thought patterns, and adopting more positive and empowering beliefs.

Here are some strategies to apply in this journey.

Embrace Financial Challenges

Dr. Wayne Dyer once said, “When you change the way you look at things, the things you look at change”.

Instead of viewing financial obstacles as setbacks, see them as opportunities for growth. For example, if you face unexpected expenses, use this moment to teach your children problem-solving skills.

Take is an opportunity to discuss and develop a plan to tackle the challenge, whether through budgeting, saving, or getting extra income from a new skill.

Practicing Gratitude

It is Max Lucado (author of Anxious for Nothing) who once said, “Gratitude lifts our eyes off the things we lack so we might see the blessings we possess”. Being grateful is a healing process that reminds us of past victories with our finances and skills. It also empowers us to try again when we have given up and to realize that a lot of what we have is not because of money.

Gratitude enables us to see money as a tool and resource rather than the all-in-all of having a good life.

Daily Gratitude Practices

Encourage your family to share something they are grateful for related to money each day, whether by journaling or by speaking it out.

It could be appreciating a budget-friendly meal, the ability to save for a family trip, or simply having a house to live in.

This practice not only promotes a positive mindset but also reinforces the idea that financial stability is a journey, not a destination.

Overcoming Limiting Beliefs

Many of us carry limiting beliefs about money, such as “I’ll never be good with finances” or “Money is the root of all evil.” These thoughts can hinder our financial growth and affect our children’s perceptions of money.

You can start your journey by taking a Moski course on personal finance, reading books or having a personal/ family money coach

Challenge Your Thinking

Just like an old habit is replaced by a new one, seek to change your money thoughts with new and better ones. For instance, when you are thinking about buying something, the old thought is “I can’t afford that”. Replace it with “How can I afford that?” This simple shift encourages creative thinking and problem-solving, setting a powerful example for your children.

Money/ Financial Coaching

Every family that is gearing towards financial success must consider having a money/ finance coach.

Families around the world face numerous challenges, from budgeting and saving to investing and planning for the future. A financial coach becomes a valuable partner in navigating these challenges, providing guidance, education, and support based on the unique needs of each family.

Financial coaching is a personalized, goal-oriented process that helps families:

- understand their financial situations

- set achievable financial and life goals

- make informed decision

- embrace education and behavior change to take control of their finances

Benefits of Financial Coaching

- Enhanced Financial Literacy as families understand budgeting, debt management, savings strategies, and investment principles.

- Customized Financial Plans based on the family financial situations and goals e.g. saving for a family vacation, planning for children’s education, or preparing for retirement. a financial coach provides the tools and strategies needed to achieve these objectives.

- Accountability and Support so that families can overcome the stuggle associated with sticking to budgets or savings plans. Coaches offer encouragement and motivation as families navigate challenges and celebrate milestones.

- Behavioural Change because the coach also helps families identify and overcome limiting beliefs about money. This behavioral, and money mindset change is vital for long-term financial success.

- Stress Reduction as a coach provides clarity and structure. With a clear plan, families can experience greater peace of mind, knowing they are taking proactive steps toward financial stability.

- Facilitating Family Discussions. Financial coaches can facilitate important conversations about money within families. This collaborative approach strengthens family bonds and ensures everyone is on the same page regarding financial matters.

Key Takeaways on Money Mindset

- Your money mindset will determine your current and future financial situation as an individual and as a family

- Changing your relationship with money is a journey for which you can get help from a financial coach