Money Matters. Master It!

Money Personality Test @ Ksh. 150

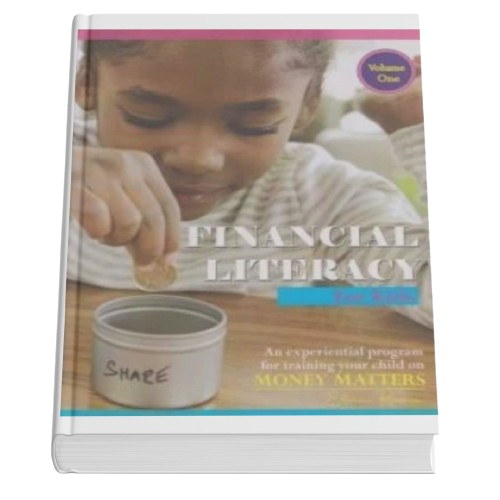

Unlock your Child’s financial success.

Create a heritage of prosperity,

Build Lifelong Money Skills,

Activate Financial Responsibility…

Our mission is to unlock your child’s financial success and empower African families by providing specialized financial literacy for children and targeted parental investment strategies, fostering wealth building, management, and expansion.

Learning designed to fit your child’s needs

Crafted courses and expert instruction that are accessible 24/7 to equip your child on their schedule.

Flexible

Tailored learning to match your child’s learning style & availability.

Easy access

Unlock financial knowledge anytime anywhere through seamless learning

professional

Expert instruction designed by seasoned industry professionals for your children.

Our Core Values

Our guiding principles define who we are, shape our decisions, inspire our actions, and express the foundational beliefs that drive Money Space Kids, as we strive to create a meaningful and impactful experience. For you and your kids.

Charting the Path to Financial Empowerment

Covering a wide range of topics, from budgeting and expense management to family & children’s financial awareness and investing options, Moski provides you with the knowledge and inspiration to take control of your financial future.

-

Making Money During School Holidays

As parents with exposure to global trends, you can guide your children toward innovative holiday income opportunities that blend traditional values with modern approaches.

-

Relationships, Money, and Your Future

Read to understand how your relationships and money intertwine in social situations, personal relationships, and even professional networks.

-

Money Lessons: Your Next Big Adventure

Financial education is crucial after high school. Discover how Moski money lessons can set you up for lifelong success and independence.